Cred: The most undervalued Gunda of India’s Startup Land

Aug, 2021

Is this click bait – NO

Am I a Cred Fanboi : NO

The only thing I love about them is they have all the coffee roasters that I love in one place (except Subko). In fact, I stood shoulder to shoulder with every other person who hated on Cred, Kunal and the FOMO driven VCs not wanting to miss the Cred boat without a clue of what they are investing in. I mean its only logical to be shat on if you are valued at 2.2 bn and you launch normie products like Cred Stash, Rent Pay and an Affiliate DTC Store.

Things got so out of hand that a newspaper wrote an article titled “Forgive us for asking, but what’s Cred’s business model?” This is my attempt to answer the same. Quick disclaimer – I have had Zero interaction with anyone at Cred (my attempts to get hold of someone when they botched up my coffee order were in vain) so this is completely an outsider’s view.

It’s easy to write off Kunal Shah as a Hype man - though he is bloody good at it – he sold Freecharge for $400mn to Snapdeal which ultimately went to Axis for just 60mn US (Paytm’s bid was 10mn). The truth is every founder wants to pull the same stunt they just haven’t been able to – hate the game not the player.

To an outsider the Cred play book looks very similar to Freecharge – Indians love free stuff – we will flock to it like bees round a honey. Kunal will pass the honeypot to a bigger player for far then its worth. There will be a flurry of congratulatory tweets from across the ecosystem hoping that the most indexed man in the Indian VC ecosystem does not upgrade form his Vespa and continues to shower his monies on them/their portfolio companies.

For most people Cred’s intent is so dense and secretive that you would not be faulted to borrow Winston Churchill’s words on Russia’s intentions in 1939 – it’s a “riddle, wrapped in a mystery, inside an enigma”.

So, why has Kunal&Co. been so discreet about what they are building at Cred? Because they are super ambitious and don’t want to get slotted into one particular box - it also lets you keep taking multiple shots at the target of becoming the most valuable startup in India. They have been exceptional at controlling the narrative - everything that the team at Cred has done is calculated and intentional (much like the latest VC twitter favourite @ultrahumanHQ)

Most founders talk about community, long term vision, design focus, first principles thinking etc – but largely as a lip service and are essentially just trying to raise their next round and keep the boat afloat. Cred seems to be different.

Lets start with who Cred want to Serve?

“For too long, startups and governments have focussed on the masses, We want to focus on the others, the ones who pay taxes. Nobody has been solving their problems.”

In other words the guys who have the money – if I could round up all the guys who can spend, lend, invest, borrow, insure, pay taxes – I can practically layer any business I want.

“Nobody has been solving their problems” – really?? We get white gloved service everywhere we go – want to open an account, the bank will literally send someone home to take a signature, want to invest there will be a personalized wealth manager at your beck and call, heck even the govt issues me an appreciation certificate for being a paying taxes and building India - but I guess more money more problems to be solved.

So how does one go about finding a common thread to stitch together a community with a large enough TAM - not just DAUs/MAUS with no ARPUs.

• iPhone owners (remember clubhouse) – naah too ubiquitous

• Car Owners – large part of ownership with older folks – not as tech savvy • Avocado Toast eaters – Too niche (HT- Sajith Pai)

History is a great place to look for understanding and designing human behaviours. Remember Crossroads, The first mall in India - seems like they had found a solution to this long back. To avoid the rush of non-spending DAUs with No ARPUs visiting the mall - Crossroads installed a policy of allowing only Credit Card holders inside the mall – the fundamental reasoning was same as Cred’s, most trusted patrons of banks so hopefully won’t shoplift and have the money to spend.

Credit Cards and Credit scores are a wonderful sieve – a semi exclusive club that is not as snooty as the Gymkhanas of Bombay yet not massy as the Udipis of Bangalore. Now if Kunal was an average entrepreneur like me he would have launched an Amex Black for the HENRYs of India and if he was a greedy bugger like my friends he would have just kept giving us ‘bread points’ and brokered the data for a hefty price ala Drop. But either of those would be a complete disservice to the beautiful mousetrap designed by the brilliant Harish Shivaramakrishnan.

I was first introduced to Cred by a CC point hacking colleague in its early avatar – being fintech enthusiast and case study loving MBA I couldn’t wait to get my hand on this shiny new app and dissect it business model ( although if I am being truly honest here, I was just being true to my Baniya roots and trying to squeeze out any value I could over and above my credit card miles):

• Float on delayed payment to CC issuer – but they settled payments almost instantly

• Sell Data – what if I don’t enable cred protect and they can’t parse my statements

• Ad revenue / Commission from Brands for gift cards –not big enough business

• Ok so like Freecharge this will eventually be pawned off to the highest bidder

Naively this is where the analysis of Cred stopped and since I didn’t follow Kunal on Twitter back then I was blissfully unaware of the great wisdom drops, occasional humble brags and social experiments routinely conducted by him on the bird site. (I do wholeheartedly share his beliefs on things like India being a status driven society, need for increasing female participation in work force and job creation as great way of philanthropy, especially the last one.)

CredCoins – the foundation of the Cred Empire

Cred launched by allowing you to settle Credit Card bills for free and get rewarded with Cred Coins – which could be ‘burned’ for cashbacks or discounted gift cards to avail online/offline services. Very MVPesque product at the time.

CredCoins are the underlying currency of the ‘trust economy’ Cred is building. The more valuable the CredCoins become the more valuable the business – this is what keeps the people coming in everything else just gets layered on top – as you will see later the CredStore, CredStash, CredMint – Cred wants to focus on owning the experiential layer and keeping its margins. The backend is a commodity business which Cred will just outsource and let the partners do the heavy lifting.

Btw, did you notice they are named CredCoins and not Cred Points – you mentioned Crypto– I didn’t

Now even if you lure people in with cash backs on Credit Card repayments it will only be used once a month. For any self-respecting consumer app isn’t daily login and time spent on app that matters??

Enter the CredStore

What does every status seeking HENRY want - DNVB brands at super low prices - Every DTC brand worth its salt has kissed the ring and offered substantial discounts to the Cred community as they go about burning coins and money on buying stuff they don’t need. Cred Shop is critical to the success of Cred Coins and in turn the platform. Cred wants to focus on moving Bits over Atoms, it will not stock inventory and will only be the platform that facilitate the trade (dare I call it an affiliate) and monetize from its partners for driving the right TG to their store.

Cred team knows the importance of product positioning and branding extremely well. You wouldn’t buy these products if they were just available at a discounted price – now you have to first earn, then burn the points to get the discount which adds a nice little gamification to the whole process and also allows brands to showcase in a controlled environment alongside the right peers – unlike Groupon which focussed only on the customer but killed the partner brand’s value in the process.

But there is only so much organic, gluten free, vegan, keto bars one can buy a month, so how do you increase the volume of spend on your platform and get a higher wallet share of your customers?

Enter CredRentPay:

Now one can diss on Cred for launching this all they want but it’s a smart move. For most urban millennials rent remains the biggest non-negotiable monthly expense. None of the landlords allow rent payment via credit card, this unlocks a completely new behaviour and increased engagement. Same goes for allowing you to pay School/College/Tution Fee on credit cards.

Higher card spend, more Coins earned on repayment, more transactions on the store, more data you get the drift.

After paying the Rent, booking a 2,200 shave at Truefitt and Hill, drinking light roast artisanal coffees, and booking a trip to Maldives to hangout IRL with my friends and fellow Cred members what could I possibly need?

A Loan – Yes that right – how else do you think I keep up with this lifestyle Creep

Say hello to CredStash

Standard personal loan product disbursed instantly without the predatory pricing of payday loans / instant loan apps. As with most Cred products it is not the What but How that matters (or Why if you are Simon Sinek). Anyone with a 750 credit score is anyways eligible for a low ROI personal loan but HOW Cred differentiates is on the User Flow - frictionless 3 step process, all native to the app. Equally important is the communication of the Value proposition – 1/3 the rate of a Credit Card – Cred is not fighting to get you the loan at the lowest rate like every other loan aggregator. Remember I said earlier they are extremely deliberate and intentional in the everything they do.

Aap Chronology Samajhiye – first came the credit scores, then the credit card repayment patterns, a readymade market of balance revolvers who are good for the money but needed credit, so now you offer them a far superior option to credit card debt – a personal loan to better manage their credit needs. Win Win Win – except for greedy credit card companies who would have made 36% APR.

Can any SuperApp ambitions be complete even begin without a Payments play.

Cred Pay is the instant checkout product from Cred that allows one click checkout from third party merchants outside the Cred App. Natively integrating cred coins with payments not only increases value of Cred Coins but also attribution for driving the sale to the merchant. Can you name any other Payment Aggregator getting paid by a brand for driving a purchase?

This product was developed along with Razorpay & Visa – follows the standard playbook: Enhances the value of CredCoins, great experiential layer and monetization from the merchant. The regulated and commoditized is not touched by Cred.

Interestingly though Cred has applied for a payments aggregator license, will be interesting to see how this piece pans out – payments is a low margin but highly strategic play and hence almost 30 companies including Zomato has applied for this – with BNPL etc the checkout wars have just begun.

Coming to CredMint the latest product feature launch by the India’s fastest Unicorn (although Mensa Brands may soon wear this crown).

One had to be blind as bat to not see P2P is as it’s grand offering (yet extremely stupid to think of it as the final offering) given all the story telling from Day 1 around trust and value unlocking and trade facilitation amongst community members etc.

P2P was the lowest hanging fruit of fintech revolution, it brings online the grey market behaviour of people lending to other people without collateral to get better returns (and tax). P2P was supposed to disintermediate the institutions who earn an arbitrage between the cost of deposits and rate of lending but never caught up in India and imploded in China– why?

Let’s look at a quick and dirty JTBD framework of a P2P exchange for its customers:

• For Borrower: provide – Lower Interest Rate + Faster Disbursement

• For Lender: be the Trust Layer – provide liquidity and security and risk adjusted returns

Unlike Banks, P2P exchanges couldn’t crack building the trust layer inhouse and relied on borrowed trust from external agencies like credit bureaus. To compensate for lack of trust layer P2Ps incited lenders by offering higher returns which ultimately led to worsening of credit profile of borrowers.

Let’s see how Cred has addresses each of these through first principle thinking and setting the right expectation by building the right narrative around trust to enable p2p lending on its platform.

Security – in absence of hard collateral lending is dependent on only two factors - ability and intent of the borrower. A community of individuals with high credit score plus visibility on an established pattern of payments of unsecured loans (credit cards). Product catering to the top 1% of Indians solved for ability and third party verified layer of 750+ Credit score solved for intent.

Returns – The returns are marketed as 2x of savings account – its important to choose your enemy wisely – Cred chose to compete with the lowest return product - Savings Account, not FD, AAA bonds or debt funds. This leads to low interest rate for its borrowers and attracts the most safe and sought-after borrower profile.

Liquidity – no while I might want to position myself as an alternative to a Savings Account it only works if I can deliver on the JTBD by a savings account. Security (DIGCGC insurance), Liquidity, Returns, Payments. For 90 % of the savings account holders that is all a savings account needs to provide - everything else a bank does is a cross-sell layer on top of this.

So how does Cred fare to a savings account –

• Liquidity: One click withdrawal to account in one working day – bearable for most people • Returns: Upto 9%on Cred – 3x better than SBI’s 2.7%

• Security – No DIGCG Insurance but lending is to 750+ credit pool (Cred could embed insurance if one chooses to opt for a lower return rate)

• Payments – Money comes in Bank account of choice + CredPay payment options

I like it when people think from first principles and build products where others have failed – specially while making it look super easy and oh so logical in the hind sight.

It is easy to argue that they should start a digital bank for the 1% tomo. but if you have been paying attention to any of what I have written that is the last thing they would want – why become a capital-inefficient and a regulated business when – they are practically a bank already with no regulatory burden that allows you to pay, lend, invest, borrow – what else do you want from a bank - an insurance - well that’s hardly a matter of discussion, you think Cred will not REWARD the MOST trustworthy Indians with lowest policy premiums?? Of course they will - but gotta save that for the next round of fund raise – now I am not the one to spy but did you see SriramK of a16z cheering Kunal on twitter. (bet they vibed on this gem - https://sriramk.com/building-unmeasurable-things)

Kunal famously tweeted that lending is a feature not a product but the rate at which Cred is going practically everything is a feature only distribution is the product. If you spend time on Cred you can see them testing customer engagement to prioritize the next product feature launch.

• Domestic Investing – they allow you to add your mutual fund portfolio – stock trading is only a matter of time. The stories tab on Cred is full of financial podcasts and news.

• International Investing – very intentional again – instead of a simple 500 bucks gift voucher Cred offers a 400 Rupee gift voucher with appreciation linked to Amazon’s stock price

• Crypto – They are called Cred Coins and not Cred Points for a reason – Cred already offers crypto based rewards for games and referrals

• Real Money Gaming – They are sponsors of IPL + mini games and jackpots are already on the app

• Fractional/ Startup Investing – Kunal is the Startup Index of India. Deal flow is hardly a challenge, I guess the wait is only for the crowd funding regulation to kick in

• Travel – already gets a separate tab – high spend and high margin product that resonates well with its TG – everyone is a travel influencer after all

• BNPL – I mean its lazy thinking to even suggest this in today’s times

Amazon wants a share of your wallet – Cred wants a share of your wallet and wealth. Simple law of economics is Income = Consumption – Savings/Deficit. Cred is positioned to play across all variables.

Here is a quick look at how a Cred User - Tanya’s journey look like once Cred is fully stacked:

Opens the CredStore and lusts after all the things she can’t afford, reads an inspiring quote in CredStories, books a masterclass on CredEd and sharpens her coding skills. CredJobs gets her placed at a startup funded by CredAngels. Moves to Bangalore, finds a credit worthy roommate on CredHomeExchange. It’s the beginning of the month, she splits the rent and utilities through CredPay and shops the CredDrops. CredInvest robo-manages her portfolio splitting it into Stocks, Bonds Crypto & fractional RE. New iPhone just dropped, she buys it on the CredEasySix plan but just then her friends plan a trip on CredTravel - salary is all gone - takes a quick loan from CredMint and insures the trip through CredSecure. Back from the holiday extremely tired, no money left to spend – burns some CredCoins to unlock an show on CredTV. A colleague gushes about the dating pool on CredMatch and signs her up. Matches with a rare non-techie Bangalorean. Things go well, parents take down her profile from FAANGShaadi.com. Sabya bride fast forwards to a CredMom community member where she gets Nanny recommendations alongside ESoP advise. Kids are expensive CredMint won’t cut it, time to go for CredStash. Kids grow fast (ask me!) time to get a CrEduLoan for the school fees and set it on auto pay next to the CredSubscribe payments for the Tesla. Her dream house just got listed by a fellow cred member on CredClassifieds – but her company is far from IPO - time to sell her shares on CredSecondaries. Shares got sold for far more than expected - feeling blessed time to donate and earn good karma on CredCharity.

(Please note that NFTs, DAOs, Metaverse, DeFi, SpaceTravel have not been included due to the author’s limited understanding of the subject, this does not exclude them from Cred’s roadmap.)

Now while I don’t have a clear answer to where Cred goes next – what I know is that they will build the experiential layer, remove all friction, design the flow from a first principle thinking and let others build the Products - they will focus on monetizing the distribution network.

Wait does that not sound a lot like the App Store??

Yes smarty pants – Cred is the App Store for anyone looking to reach the 1% of India – every product Cred offers is no different than an app built by someone on the App Store.

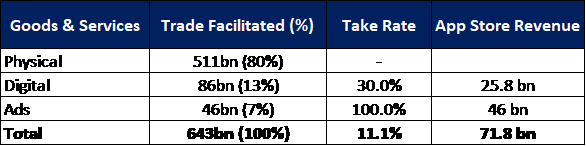

Apple App store facilitated ~650bn worth of trade last year of which 511bn (80%) was Physical Goods and Services which it could NOT monetize – the unique model of Cred allows it to monetize even the physical goods and services flowing through the CredStore.

Apple App Store Revenue 2020

Now if you indulge me lets look at why I feel the App store for India’s 1% is undervalued.

Thank you for coming to my CredTalk.

PS: Kunal if you are reading this, now you know I find Cred & CredCoins grossly undervalued, can I please get an allocation in the next round – possibly subscribe using my CredCoins?

*this piece may not be minted into an NFT without prior permission of the Author.

**Views are strictly that of the employer and not personal!