Having never written a single line of code and largely specializing in high-yield credit /special situations investing, the world of Venture Capital has been nothing short of doing an MBA all over again.

I could brag about how smart I am to break into VC, but this was entirely thanks to Shalin Shah at Core91.vc who in typical VC fashion bet on an outlier like me. I’d like to bet that his bet turned out fine!

With 9 investments done, I decided to reflect on the year gone by to capture my learnings (truth be told I am just hoping this goes viral on Twitter/LinkedIn and I get some solid Deal flow – TLDR: VC is all about Deal Flow, all the social media theatrics you see from VCs is primarily to attract Deal Flow).

I have benefitted heavily from the writings of other VCs, founders, failed entrepreneurs, industry observers which I have copied, modified and even disregarded to develop my own mental models.

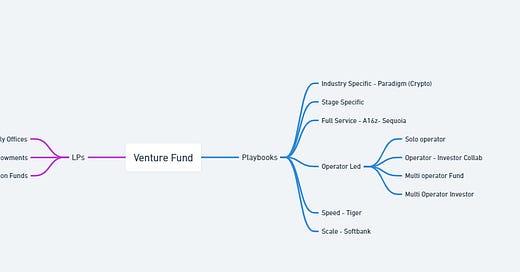

Knowing where you sit in the Value Chain

Before I start talking about investing, it’s important to understand where a VC sits in the value chain so it lays out a better understanding of the objectives, intentions and expected results.

For a VC firm LPs are the Clients and Startup is the product. LPs sit at the top of the food chain and no VC fund will take an action that is detrimental to the LP, a smart entrepreneur knows this and plays the game accordingly. S(he) knows that if there is a conflict of interest between the LPs and the Company, the VC is most likely to serve the interest of the LPs as they are the source of his future capital.

Power Laws

I have not seen any other industry where Power Laws are more prevalent – be it for raising a fund or in generating returns. VCs think in bets and while your startup is dearer to you than your first born, it is just one of the many bets within a VC portfolio. Typical VC portfolio will have 40% of the companies go to 0, 30% returing the Principal and balance 30% returning the entire fund or more.

For a VC all startups in their portfolio are not equal just like all clients are not equal for a founder. They will ration their time, capital, energy and networks for the winners as anyone would. (Afterall who doesn’t want to bask in the reflected glory at the Opening Bell on their portfolio company’s IPO)

Know this and play the game accordingly. Hate the game, not the player.

So, What is the JTBD of a VC

(Cant write a post on startups without referencing Clayton Christensen, can I?)

Turns out, what founders ultimately want from VCs is - Better Odds. VCs are happy to add value but also know that the best entrepreneurs don’t need their handholding.

Ok so this is beginning to sound like a VC bashing post, but it’s not – I fundamentally believe that VCs are value accretive to the society (even the ones who invest purely out of FOMO in 10 minute delivery companies) as they channel increased risk capital to back courageous founders in bringing unique solutions to market and end up creating multiple positive sum flywheels in the process.

Personal Notes:

Change of Mindset

My success in late-stage credit was heavily dependent on ‘boxing the risk’. I was rewarded for digging deep and identifying risks that aren’t apparent at the surface level and formulating Plan B & C to recover our monies should the risks manifest themselves. VC is a complete 180 degrees turn, you are rewarded for backing people who are dreaming up possibilities and converting them to opportunities. In my previous avatar my success depended on saying ‘This Won’t Work’, now I try and find every reason to say why THIS WILL WORK!

Industry Knowledge is only half as important

My professional journey has taken me from healthcare investment banking with a global bank to hospitality and real estate consulting firm with just a 3-member team; from partying with fashion models to building credit underwriting models; from founding a diagnostics and life sciences venture in the middle of a pandemic to backing founders building category defining companies.

80% of what happens in all the businesses is the same, 20% is what is unique to the industry and the company. On a long enough time-scale successful businesses are built to create and capture value. Routes and timelines may be different but they all merge into the same ocean of Public Stock Markets which operate on fairly straight forward, non-community-adjusted EBITDA, metrics.

The following mental models have helped me put some structure to zero in on opportunities – this is by no means a complete list or a template for finding winners. This is not an investment thesis either, as each firm has its own thesis from the famous ‘Prepared Mind’ approach of Accel to ‘Bottoms Up’ approach of Benchmark. These are just some short hands that help me navigate my decision making when engaging with early stage Pre PMF companies.

While Core91 invests in B2B SaaS companies, I have kept the frameworks broad and can also be applied when evaluating B2C companies. (I am fascinated by Consumer Social - will cover that in another post)

I typically evaluate a company through two lenses:

- The Eagle – High level (TAM, Concentration, Industry)

- The Frog – Down in the details (Product, Team, Distribution)

The Eagle Lens:

TAM, SAM, SOM - DOM call my MOM!

- Ask any VC and they will say the TAM is often the biggest determinant of success

- Many deals often get rejected on a small TAM – Avocado Scoopers for India Alpha1

- TAM Calculation is often the most abused slide one will come across in a pitch deck

- When I am limited by my ability to imagine a big enough TAM, I ask:

o Would the solution increase the Affordability to bring in more users in the fold?o Would the increased frequency and use cases increase the TAM?

o What adjacencies can the product cover and increase its TAM in the long term?

o What PEST structural changes will grow this nascent market?

o Ultimately if all the ducks align as per founder’s hopes, how big can it get

Often the founders (Slack), investors (Bessemer–Shopify) and consultants (McKinsey–Mobile) underestimate “How Big Can it Get”!

I have found it helpful to abstract and see if the startup serves an inherent need currently filled by a substitute. We are bullish on B2B SaaS as the biggest competitor to most B2B software still remains human capital running processes on Excel and Paper.

Trillion Dollar TAM is great but show me the Path to the First Million and then to 10

- Top-Down analysis of TAM is good but of no use without a clear monetization strategy

- Startups are for-profit enterprises and need to solve customer problems profitably at scale

- While there is no direct relationship between excel projections and how the market will behave, this forces a founder to think through a Bottom-up construction of TAM, define ICPs, outreach strategy for those ICPs in a cost-effective Manner, ROI and Pricing

- Founders with a GTM and Distribution focus stand out and will survive the WINTER

As an early-stage investor my worry is not that the startup is operating outside a Trillion Dollar TAM, but is it solving a hair on fire problem that people are willing to pay for. Planning beyond the ‘First Million’ is futile at Seed/Pre-Seed but not having a plan on how it will scale to 10mn shortly is a red flag. At 10mn one can expect a decent PMF and pour fuel on the fire. At 100mn there are multiple adjacencies that open up to add to the flywheel.

Two things I learnt early on

- Sales solves everything

- Low CAC/LTV absolves you of most sins

In SaaS, Unit Economics are fairly straight forward as long as the ‘Magic Number’ is in check. For other businesses favourable unit economics at scale are critical, this is especially true of ‘Technology Enabled’ businesses which are delivering solution in an Atoms world – LTV/CAC of at least 3:1

TAM > Revenue Path > Concentration & Stack Rank

-After evaluating TAM and Revenue path the next thing I want to examine is how will the market evolve as competition comes in – What would be the Concentration Ratio?

-Big market without high concentration will not lead to big businesses

-Concentration Ratio of CR3/CR7 means the combined market share of top 3 or 7 companies will largely represent the entire industry

In hard fought categories it’s important to also understand the concept of Stack Rank (well-articulated here by Sajith Pai). As an investor you want to bet on most dominant & efficient player.

TAM > Revenue Path > Concentration > Network Effects

- Network Effects are the holy grail of software businesses and I found this Network Effects Bible from NfX is extremely useful for deep diving into the subject

- Simply put, as the business grows does it creates significant advantages in user experience, acquisition of new users and cost of serving the user

- Not all Network Effects are equal – value depends on level of activity, single v/s multi player mode

- If Network Effects don’t create a big enough barrier for new entrants, then a startup is unlikely to have a moat as a result of those network effects

TAM > Revenue Path > Concentration > Network Effects > Moat

-One of the best definitions of MOAT that I have found has 3 Ps: Proven, Perpetuating and Permanent unit economic advantages that are hard to build for their competitors

-If that CAC remains high or repeat transactions need to be subsidized even as the startup starts to dominate a market then essentially there is no real MOAT except Capital

-Great startups have measurable, quantifiable and significant economic leverage that can sustain for long periods of time even in the face of competition

-‘Value Creation’ without meaningful ‘Value Capture’ can’t create sustainable businesses

(may be the Oracle of Omaha was right about wanting sharks swimming in his moats)

The Frog Lens

Getting into the nitty-gritties of what makes the team and the product so special!

Navigating the Idea Maze - The rule of 5

-Idea Maze is a concept popularized by Balaji Srinivasan

-Ok so I made up the rule of 5 – but I find that every founder who has truly been through the Idea Maze can do the following 5 things

Explain the product to a 5-year-old (or a not so intelligent VC associate)

Teach you 5 things about the market and product that you can’t just google

Break down the solution into measurable KPIs and limited assumptions

Makes you believe that success is inevitable - it’s a question of when and not if

Make you think of giving up the VC role and join them as an Operator

The best pitches I have sat through are nothing but a story of the founder navigating the idea maze - thinking through the deepest questions around the problem, examining the history of the industry, past failures, anticipating the challenges and devising multi-pronged solutions

As Peter Thiel says, “Every great company is built on a secret that’s hidden from outside. A great company is a conspiracy to change the world, when you share your secret, the recipient becomes a fellow conspirator.”

Product First v/s Distribution First

-Are the founders obsessed with product or distribution?

-Is distribution baked into the product?

-Are there platform currencies that can be used to create referral/content loops which help in organic distribution?

-Does the product have a differentiated distribution strategy which isn’t obvious or easy to copy?

-Undifferentiated GTM results in High CAC and low margins

Back in the day, one could say, battle between every startup and incumbent comes down to whether the startup gets distribution before the incumbent gets innovation. Today startups are fighting against bigger ‘startups’ with established distribution and agile tech teams, hence distribution first approach along with having depth in the product is critical to not be reduced to a feature.

Swaypay: In a hotly contested checkout real-estate space, our portfolio company Swaypay has a unique advantage to acquire Merchants and Customers. Swaypay allows shoppers to convert their social capital to currency by giving a discount if they post their purchase on social media. The Swaypay hashtag on Social as well as the Swaypay button on checkout builds an incredible powerful free distribution loop from every transaction.

Product Level Evaluation for SaaS Businesses

Some of the product related attributes that I find useful to evaluate SaaS businesses include:

-Cost Saving Vs Revenue generating; a system of record; high switching cost; embedded; scalability and defensibility; frequency of use; sales cycle, PLG, motivation and ROI for buyer

-Good software is opinionated – focuses on removing friction in the client’s workflow rather than just friction within the software. As with consumer, clients are ok to learn as long as the perceived benefit from the software outweighs the effort needed to learn

-Horizontal SaaS – Opinionated; Specific use case; Frequent

-Vertical SaaS – Bundled industry specific workflows; Atoms Industry

Essenvia: I first interacted with Essenvia while I was still at NeoDx. As a medical devices company, we were spending a significant amount of time and money on consultants to help get regulatory clearances. 15 mins into the demo, our team wanted us to migrate to Essenvia. They are solving a hair on fire problem, for a large industry, acting as a system of record leading to long term contracts. The team was ok with the learning curve as they saw clear benefit of reduced costs and increased revenue due to faster time to market using Essenvia.

Metrics are Useless

- The stage at which we invest, especially in B2B SaaS, focusing only on metrics is fairly useless

- As I have learnt first-hand, majority of the First Customers are acquired in myriad ways and it’s difficult to distinguish from authentic, unaffiliated customers who are engaging purely for the same use case that you are eventually betting on

-Unless the traction is off the charts for the intended use case early stage B2B SaaS is a bet on the team, the market and their vision on creating a product that captures a large market share

Product-Market Fit or Market-Product Fit

Founders often approach building their startups in one of the two ways

-Designing a product for a problem/s faced by a target customer segment. Prone to pivots, much more flexibility on the final product

-Strong vision/product statement with multiple possible markets/users with a bet on being able to showcase the value to users

Unless dealing with a super-star repeat founder with a strong product vision and the ability to pull in extreme amount of capital, talent and unique GTM to acquire customers or create markets – I would prefer to stick to Marc Andreesen’s words, “In a great market—a market with lots of real potential customers—the market pulls product out of the startup. The market needs to be fulfilled and the market will be fulfilled, by the first viable product that comes along. The product doesn’t need to be great; it just has to basically work.’

Quest.ai is a Market Product fit bet we have taken at Core91. Nagesh and team are serial entrepreneurs with strong technology chops. This team of ex-game designers believes that designers want more autonomy to bring their designs to life and not be boxed in templates or run back and forth with the engineering team. They are creating a collaborative tool that allows teams to build a frontend 90% faster by generating pixel perfect React components from Figma components. Their product is seeing traction from multiple markets including Digital Marketing Agencies, Web3 teams, early-stage startups, freelancers.

Startups Building in a Competitive Market

-Cracking crowded markets boils down to finding the sharpest wedge

o Either a 10x Product

o Small unserved segment of the large market

-Founders have a clear path to either capture a small part of a large market or a large part of a small market before eventually grabbing the larger market

-This wedge product needs to be an order of magnitude better than alternatives, making it a no brainer for adoption by the target segment.

Hypto: The Hypto Hustlers are on a mission to standardize APIs for every banking product. While they started in the competitive base payments layer – their wedge was the Crypto Market – a segment ignored by traditional players. Today, Hypto is India's preferred on/off-ramp service processing $3 Bn+/month & 300k+ transactions/day.

Mercenary vs Missionary Founder

- My fundamental belief is that no one grew up dreaming of selling Insurance or Credit Cards as their sole purpose in life, yet they are fundamentally strong businesses

- Many funds favour Missionary founders over Mercenary founders as they believe they can outwork and outlast the Mercenary founders when the going gets tough. The counter to that is they can be too passionate and purists and not have the KPI driven approach of a Mercenary

- Personally, I don’t have a preference – but nothing is more repulsive than seeing a founder invent a fake story of having a personal connection with a problem to appear mission driven

- And if selling Insurance is what your dreams are made of then don’t let the missionary schpeel stop you from ‘reinventing a new collaborative risk sharing approach to impact a billion lives’

More than Mercenary or Missionary, exceptional founders are passionate – their passion is infectious and turns them into a vortex that attracts top talent, capital and customers.

Ultimately VC investing is about investing in people. The founders can pivot, markets can change, products can evolve. Having seen multiple founders in our portfolio successfully pivot (Kubric>>Mason, Bank91>> Card91, Fanplay>>FunctionUp) to achieve PMF, I am confident the best returns will always come from betting on the right people.

It’s important to note that all this only works, because we don’t follow a spray and pray investing thesis. When confused regarding an investment at Core91, we like to think of the deal in isolation and ask ourselves – would we write the check if this was the last deal from the fund!

Converse to what I felt from the outside, VC is not a sexy business - its tons of cold calling, begging to get in deals, paperwork and kicking yourself for missing in front-of-your-nose deals. Actually, who am I kidding, I get to spend hours learning about new industries and products from some of the smartest minds who share unique insights and are grinding hard to create category defining companies against all odds. Where else does one get to experience this?

Still Pre PMF,

Keshav

PS. PPS.:

FOMO, Whisper Networks, Consensus, Biases, Past Experiences are all true and exist in the VC world. Ultimately as a founder and an Investor you need to choose carefully who you partner with. There are saints and sinners on either side of the table. You attract the portfolio/cap table you seek.