“Show me the incentives and I will show you the outcomes” – Charlie Munger

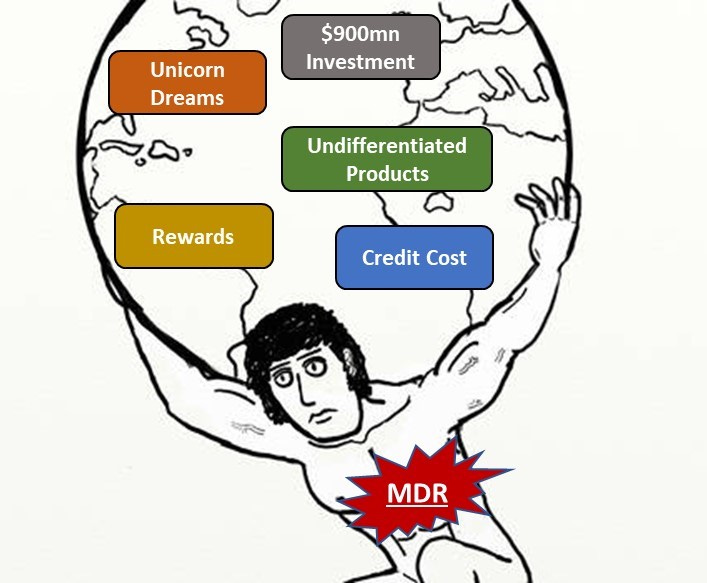

Earlier this week Jaspreet Kalra wrote a well-researched piece on Indian neobanks in The Ken. “For Indian neobanks, raising $900M in funding was the easy part. The hard part was developing an identity, which is now a bit of a crisis. Slick features and offerings have attracted a few million users, but growing revenue will require changing customer behaviour and building trust.”

For a while, I have been thinking about what a unique ‘India First’ neobank could look like, so when I read the article I decided to outline a possible approach for a neobank to develop an identity, grow revenue, change behavior and build trust.

Everything in finance is either Manufacturing or Distribution.

Neobanks chose the distribution route and left the manufacturing to “museums of technology”. After all, in theory it’s impossible for the old guard to out-compete the Third Wave sipping growth teams and Apple laden UX designers in the game of LTV/CAC, given the legacy tech stack and branch heavy models of the banks.

Bill gates said – “Banking is necessary, Banks are not”.

So, let’s examine the JTBD of a Bank as per HDFC (looks like I can’t ever write an article without JTBD).

The only essential part of Banking Products are the two red circles - fundamentally banks operate within the arbitrage between Deposits and Loans. Everything else is cross-sell and non-essential.

Wealth management, credit cards, ATMs, interchange on payments, Forex, etc. Everything can be seen as modular functions that one can outsource and build a completely fragmented business. To win against compete with banks you need to have access to low-cost deposits and the ability to manufacture a quality credit book.

So, we have now established that Bill Gates is indeed a genius and banks are unnecessary – but then why have they not been obliterated (yet) into oblivion. The simple answer, it’s not the products - the hidden engine that fires it all is Trust. Trust, is what brings them billions of dollars in revenue, despite all their glitches and scams! When people lose Trust in banks, they get a backstop on the Govt – your savings are insured by DICGC of the Central Bank.

Branches are as expensive for banks as they are for a Neo bank, but does HDFC/ICIC/Kotak not know that?? This is neither an earned secret nor did they need to hire consultants from McKinsey or BCG for this – yet banks continue to double down on opening more branches. Why?? Branch gives visibility, fosters trust and puts a face to an otherwise faceless entity. Also, how else do you reach the people outside the 150mn fintech TAM.

With regulator in no mood to issue digital bank licenses or letting fintechs exploit regulatory arbitrages – it is safe to assume that the current playbook for neobanks needs to change.

Even outside the regulatory arbitrage that traditional banks enjoy – things seem to be heating up - as Alex Rampell of a16z says, “The battle between every startup and incumbent comes down to whether the startup gets distribution before the incumbent gets innovation”. With the likes of Zeta and tons of other fintech infra players – that time to crack innovation is shrinking for the incumbents.

So where do Neo Banks stand today?

2% of total Bank Accounts

Operating on Business Correspondent license (dependency and conflicts)

Not the primary Banking account (Neobankers have 2-6 traditional accounts)

Limited Deposits (~Rs 5,000 balance)

Why?? Because, nobody needs another Bank account – what people need is a solution and when you stand for everything you stand for nothing, or in startup terms you lack Product Market Fit.

“Show me the incentives and I will show you the outcomes.”

While the article argues that lackluster deposit is a symptom – I believe that it is the very unintended outcome of all the inputs they had built in the first place. In the JTBD of all things Banking – Neobanks prioritized Payments over every other product – this could be for multitude of reasons including but not limited to – MDR from payments, low friction product, frequency of use case, zero commissions on investing products etc.

Every VC backed founder knows the following equation of Revenue Growth and builds their business around it.

Building a business on negligible MDR and then going upstream through cross sell is hard – like really really hard – don’t listen to me - just ask Paytm or PhonePe.

Paytm: Users - 333mn; loans– 2.6mn (0.8%); unique insurance cust. - 11.3mn (3.4%)

PhonePe: FY21 revenue 686 Cr – insurance commission rev- 3.85 Cr (0.6%)

While this looks great on an excel, cross-sell fails because its disjointed, driven by different teams with unaligned objectives. As is well established by Conway’s Law – software/product produced by an organization will mimic their organization's structures.

Even though the future may not fit the containers of the past, it’s important to examine the history of some large banking institutions. Be it the Medici in the 1300s Italy or HDFC and Kotak closer home, their beginnings can be traced back to a lending company that went upstream to lower their cost of capital by collecting deposits – not the other way round.

But fintechs don’t want to be seen as lending business - lending businesses have low valuations due to low entry barriers, extremely capital-intensive nature and sensitivity to defaults, all while operating in regulated environment. Branding of a ‘Neo-Bank’ plays extremely favorably - the promise of software like scalability and trust + stickiness of a Bank. Although, as article rightly pointed out, most neobanks resemble Wallets and Payments apps (valued significantly lower) instead of Banks.

Of course, it’s easier to talk about problems and offer no solution – but as a VC I have to ‘Value Add’ and sound knowledgeable about stuff – even if I have no deep understanding of the same. After all there is too much competition these days from thread writing ‘thotboi’ PMs on twitter!! (the same ones who write deep threads around customer obsession and solving inherent customer pain points – yet ship products built purely around their business economics or worse employ Dark Patterns so deep that its harmful to an individual’s credit and mental health scores – customers be damned!)

REbuilding a Neobank

It’s fairly established that neobanks are largely catering to millennials. After all, the magic no of 440mn millennials accounting for 40%+ of India’s workforce and spending over USD330bn – is no joke and every entrepreneur should rightly go after them. The problem arises when we bucket them all into a single group - while they have the same demographics, they have vastly different psychographics. A person born in 1982 is 40-year-old today and has very different earning and spending profile as compared to a 27-year-old born in 1995. Not all of them are interested in buying Turmeric Lattes and Avo Toasts.

What they do have in common are their aspirations - buying the first home remains the ultimate dream for most Indians not just from my parent’s generation but surprisingly post covid 75% of millennials too want to buy a home.

Home buying is one of the largest financial decisions in a person’s life time and provides a great canvas for a neobank to influence each step of the journey, increase deposit/AUM, create stickiness, and achieve a super high LTV – all while delivering value to customers at each step of the process and building trust in the process.

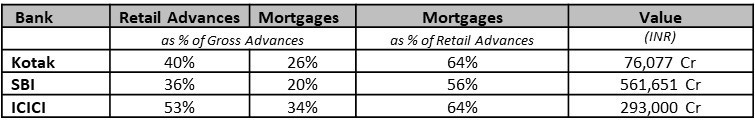

Purely from a TAM perspective – Mortgages are the largest lending opportunity for fintechs. Have you ever tried taking a home loan – banks will make you sign up for a new account, force you to shift salary credits, make you buy insurance, will your kidney and sign off your income till your great-grandkids graduate college. Mortgages are the holy grail - the past present and future of retail banking - yet no neobank has touched it.

A neobank built around renters and prospective homeowners who have a timeframe to own their first home in the next 5-7 years. I wouldn’t want to go after the ultracompetitive refinance market or for those who are already qualified/approved to buy a home today. Good luck keeping your CAC down as you fight for keywords against your competitors, developers, insurance salesmen, RE brokers, décor and furniture companies, modular kitchens, paints and a 100+ other vendors looking to engage someone in the market to buy a house. In fact, a platform that has a sticky relationship with future buyers will be happy to take the ad dollars from all the above folks with a smile.

The platform has to stitch together a journey as a progression - not a cross-sell engine - towards a shared vision of helping renters become homeowners. Every financial data point will be evaluated and every product will be offered in that very specific context, as the customer navigates the 3Bs of Budget. Build. Buy their first home before they turn 40!

A very high-level overview of the offering:

Budget

Leverage APIs from proptech/listing platforms to budget the amount required by factoring in location, pricing trends, upcoming supply, configurations, etc.

Leverage AA & CAMS to identify savings, investment, loan accounts and determine deposit shortfall and future loan eligibility

Leverage income data from LinkedIn/Pave to better model out future income

This will not be a generic budgeting tool with multiple goals/pockets/jars – instead it will have specific recommendations on cementing the best path to homeownership in the desired timeline

Build

Pay –Credit Card rewards points redeemable only towards home purchase

Save – Roundups, IFTT, Boosts, auto pay check split

Invest – MFs, REITs, Housing Inflation Indexed products

Credit score builder through rent and utility payment reporting

Free up cash blocked in Security Deposit through Insurance/Rental Bonds

Gamify entire journey to save and build up deposits, pay down high-cost debts

Buy

Buy - homes through concierge assisted journey or via proptech partners

Borrow – Best home loan rates through partners/co-lend (stickiness as credit card points redeemable against interest pay out)

Insure – Self/home insurance on purchase

Shop – Value added Services for interiors, movers packers, valuation, legal etc.

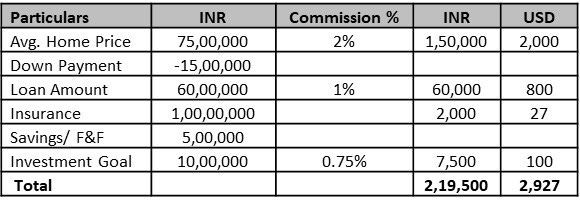

So even if one was to agree with the thesis that customers prefer products that solve their pain points instead of having bank accounts, will it make more money?

Hidden deep inside this fintech report by Blume Ventures on Page 27 I found that a neobank’s LTV is ~70$ over 5years – leading to an ARPU of 15-20$.

A quick back of the envelope calculation for this model is :

*Excludes income from MDR fees on payments, advertising, value added services etc.

So can the neobanks not win with their current approach?? Of course, they can – I and each 900mn of their crisp VC dollar bills believe so - this is just an alternate exploration of what my middle-class aspiration focused neobank could look like.

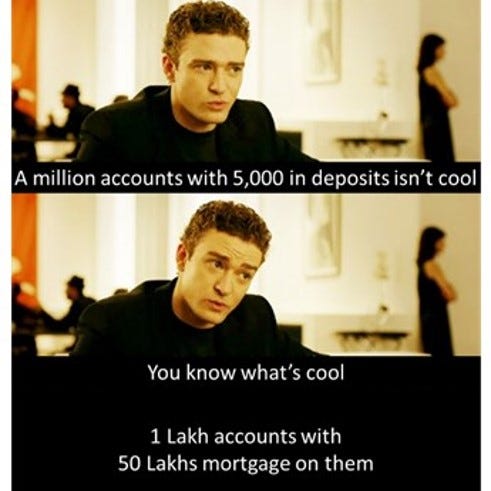

But, what if I told you this is not even the real game – this is just the mousetrap – you could give away all of this for free and still become a Decacorn?? Well, the day you hit 1 Lakh mortgages, you unlock level 2 – Mortgage Portability.

Want to know how? Can’t give all my world domination plans here for free, book a call.

Keshav.jain@frustratedmortgagor.com

Parting thoughts:

You won’t join a gym that only upsells you protein shakes and personal trainers

You won’t eat at a restaurant that suggest you the only the most expensive wine

Yet we keep our money with a Bank that only want to upsell you insurance, credit cards and loans

Most people have financial insecurity and think about making more money a few times a week if not more - yet no bank helps their clients make more money.

Not spend, invest, loan more money – but actually MAKE more money.

Wouldn’t it be interesting to build a bank that apart from the regular banking stuff, gives you the tools to make more money in your day jobs or through side gigs. I have a few ideas, that I would love to jam on.

If you’d be keen to build them out – give me a call!

Brilliant article! Like the way you've laid it out.

Great Article. Very well captured!!